ESG reporting: What companies need to consider today

Today more than ever, companies are caught between economic success, social responsibility and regulatory requirements. Customers, investors and supervisory authorities demand more than good intentions - they demand measurable sustainability. This is precisely where ESG reporting comes in.

But what does ESG mean in concrete terms? What obligations arise - and how can the effort involved be turned into real added value?

What is ESG - and why is reporting so important?

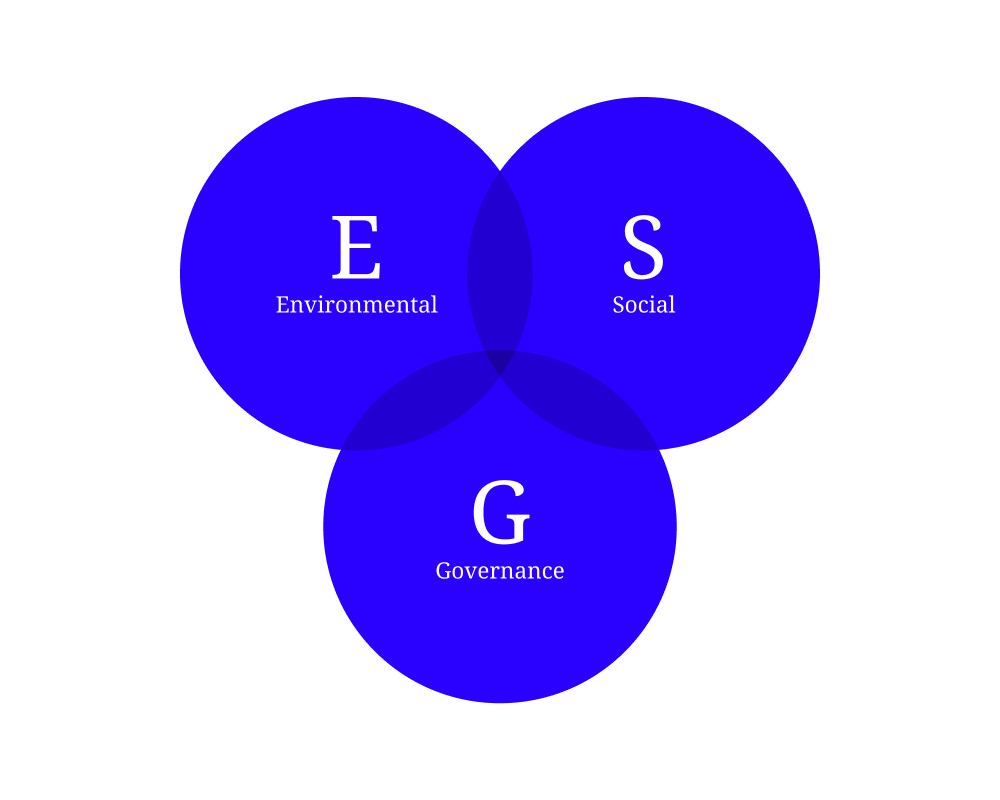

ESG stands for Environmental, Social, Governance - in other words, environmental, social and corporate governance. These three areas are considered key factors in assessing a company's sustainability performance and future viability.

- E - Environmental: carbon footprint, energy consumption, resource management, biodiversity

- S - Social: working conditions, supply chain responsibility, diversity, human rights

- G - Governance: business ethics, transparency, supervision, remuneration, anti-corruption

An ESG report documents how a company deals with these aspects - and offers investors, business partners and the public a systematic overview of risks and opportunities beyond traditional financial indicators.

Compulsory instead of optional: the new ESG regulation

What used to be voluntary is now often required by law. The EU's Corporate Sustainability Reporting Directive (CSRD) has brought a completely new dimension to sustainability reporting since January 2024:

Large companies with more than 250 employees or over 40 million euros in turnover are required to report. Capital market-oriented small and medium-sized companies will also be included from 2026. Many suppliers are already indirectly affected - because large clients require their reports.

The CSRD requires the application of the new European Sustainability Reporting Standards (ESRS). Companies must disclose in detail how they integrate environmental and social issues into their strategy, risk management and target systems. The main new feature is the so-called principle of dual materiality: it is no longer enough to simply show how sustainability affects the company - it must also be shown what impact the company has on the environment and society.

What other standards play a role?

In addition to the mandatory EU requirements, many companies utilise additional voluntary frameworks, such as:

- GRI - for transparent stakeholder communication

- SASB - for industry-specific financial relevance

- TCFD - for climate-related risks and opportunities

- ISSB (IFRS S1/S2) - for international comparability

Listed companies in particular are therefore faced with the challenge of combining several standards in a coherent and consistent manner - in terms of regulation, content and communication.

ESG is not reporting - it is management

Many companies still regard ESG as a mere reporting obligation. But those who treat ESG merely as a ‘mandatory task’ are wasting potential. In reality, ESG is now a management tool that has a direct influence on financing conditions, ratings and business relationships.

Rating agencies and funds scrutinise sustainability information with the same care as balance sheet figures. Companies that do not integrate ESG into their operational management - for example in their risk matrix, controlling or product development - will find it difficult to report credibly. ESG reporting shows how seriously a company takes its management responsibility.

Avoid greenwashing: Quality beats PR

The requirements are increasing - and with them the expectations. A symbolic commitment to sustainability is no longer enough. It's not about fancy wording, but about substance.

Data must be verifiable, consistent and reliable. Data collection processes should be transparent. The impact must be verifiable and, in the best case, independently verified. Companies that create clarity here strengthen their position - not only with investors, but also with customers, employees and regulatory authorities.

ESG as an opportunity - not a burden

If implemented correctly, ESG reporting can become a real competitive advantage. Companies that create transparency increase their attractiveness to investors, improve their own risk management and set clear internal targets. ESG helps to anchor sustainability strategically - not only in terms of communication, but also operationally.

Particularly in times of growing uncertainty, ESG performance becomes an indicator of future viability. Companies that see ESG as a strategic management task are not only compliant - they are more resilient, more credible and more successful in the long term.